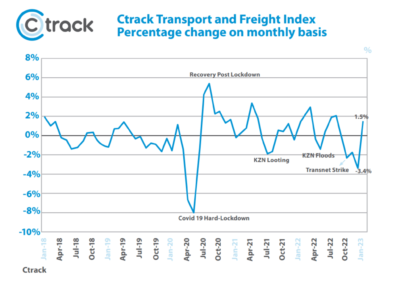

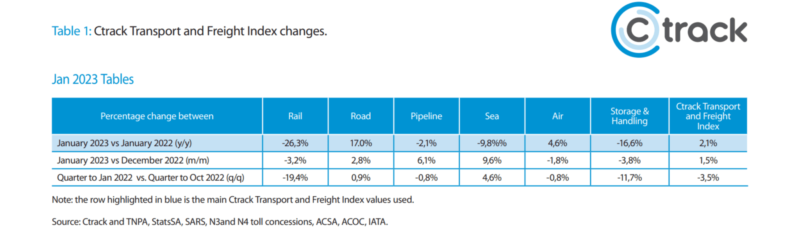

Following four consecutive months of contraction, the South African logistics sector as measured by the Ctrack Transport and Freight Index recovered considerably during January, though off a low base. The Ctrack Transport and Freight Index increased by 1.5% in January following a monthly decline of 3.4% in December (and declines in the preceding three months). On an annual basis the Ctrack Transport and Freight Index ended 2.1% higher than a year earlier, a far cry from the annual growth rate of 13.7% recorded in August 2022. The sector has faced many headwinds during 2022 and still finds itself in recovery mode as we enter 2023.

The detrimental impact of the Transnet strike on the logistics sector in the final months of 2022 as well as the growing voice of business decrying the dismal state of the rail industry have, at last, resulted in some attention from government. During the 2023 National Budget presented by Finance Minister Enoch Godongwana on 22 February 2023 government acknowledged that constraints in logistics had negatively affected economic growth and employment

Quoting from the 2023 Budget Review document:

“More than a quarter of long-distance freight traffic has shifted to roads in the past five years as a result of severe deterioration in the freight rail network.This is due in large part to historical underinvestment in the network. Prolonged power failures and poor operational performance of transport industries continue to hamper operations and investment in manufacturing, mining and agriculture. Several reforms are under way to improve the performance of the transport sector, specifically freight rail and to improve the capability of the state”.

Graph 1: Ctrack Transport and Freight Index % change on a monthly basis

More important than the acknowledgment, was the invitation to the private sector to get involved in a potential solution. Government is currently pursuing greater competition in transport and logistics through third-party access to the freight rail sector which is now in a pilot phase. In addition, several other reforms are in place to support recovery in the transport sector, which were also pointed out in the budget speech including;

- The Economic Regulation of Transport Bill, which will establish the transport regulator, has been tabled in Parliament.

- Transnet is taking steps to improve operations in key corridors, for example software upgrades that will increase efficiency through better signalling.

- Additional intervention in the form of steps to prevent theft and vandalism and resolving legal challenges in relation to locomotive procurement.

- The operations and infrastructure management functions of Transnet Freight Rail are due to be separated by October 2023, a step intended to facilitate competition and improve pricing.

Rail Freight was the worst performing sub-sector of the Ctrack Transport and Freight Index in 2022 and has been underperforming for years, so steps to address the sector’s challenges are welcomed and if these steps are implemented it could potentially be a major boost for the logistics sector. The Rail Freight component of the Ctrack Transport and Freight Index declined by 26.3% year on year in January 2023, the 10th consecutive decline recorded.

“It is very heartening to see that the transport industry formed such a big part of this year’s budget speech. We can now only hold thumbs that the proposed reforms are put in place efficiently and effectively as they are most certainly required for the ongoing survival of many of the sectors of the transport industry,” says Hein Jordt, Chief Executive Officer of Ctrack Africa.

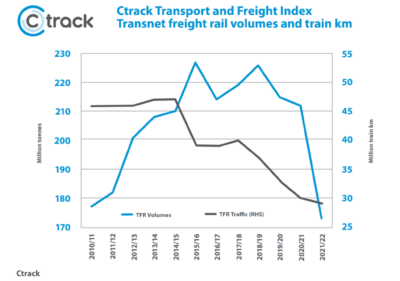

Graph 2: Transnet freight rail volumes and train km

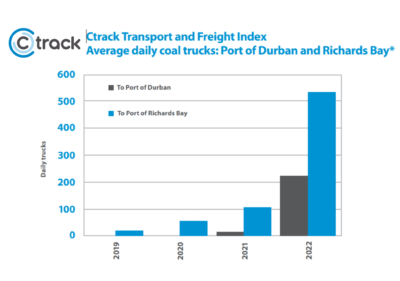

While the obvious beneficiary of the dismal state of Rail Freight has been the Road Freight sub-sector, the growing number of heavy trucks on South African roads is having a continued negative effect on the quality of the road network and has accelerated the need for ongoing maintenance.

The additional allocation of R12.4bn in the 2023 National Budget for the rehabilitation of provincial roads, to reduce the road rehabilitation and strengthening backlog on national roads is welcomed and will result in spending on roads increasing from R61.8bn in 2022/23 to R85.5bn in 2025/26.

The budget also noted that the South African National Roads Agency Limited will increase the length of the network in active maintenance from 1 200 kilometres in 2022/23 to 2 400 kilometres in 2025/26, and the length of the network in active strengthening to 600 kilometres by 2025/26.

The number of heavy trucks on both the N3 and N4 toll routes increased in January 2023 compared to a year ago, while the Road Freight payload for the country also continued to grow. This is confirmed by the fact that the Road Freight component of the Ctrack Transport and Freight Index increased by 17.0% year on year in January 2023, the 22nd straight month of double-digit annual growth.

The Air Freight sector, which turned out to be one of 2022’s star performers, showed signs of moderation in January 2023. All the underlying components of the Air Freight sub-sector declined on a monthly basis, including total consolidated airport flight movements, which decreased by 1.9% while cargo on planes decreased by 9.9% in January. According to the International Air Transport Association (IATA), the lower demand for air cargo is now evident across the globe, reflecting the multiple headwinds facing the global economy and spilling over to trading partner countries.

Graph 3: Average daily coal trucks: Port of Durban and Richards Bay*

Air cargo tonne-kilometres (CTKs) to Africa was down 10% year on year in January. The Air Freight component of the Ctrack Transport and Freight Index subsequently declined by 1.8% in January compared to the previous month, but still grew by 4.6% compared to the same period last year and 7.8% year on year ending in December.

The Sea Freight component of the Ctrack Transport and Freight Index component declined by 9.8% in January compared to a year ago but increased on a monthly (9.6%) and quarterly basis (4.6%), reflecting a hesitant recovery in Transnet ports’ activities following the prolonged strike in October 2022. However, container handling in the country remains 33.8% below the September 2022 pre-strike level. Cargo handling was also negatively impacted by the strike and has only partially recovered in the past few months, confirming fears that it will take the industry months to recover from the crippling strike.

The Storage and Handling sub-sector of the Ctrack Transport and Freight Index sector was under pressure for most of 2022, with a trend of declining inventory levels evident before the Transnet strike just made matters worse. Storage and Handling declined by 16.6% in January compared to a year ago and declined on a monthly (-3.8%) and quarterly basis (-11.7%).

The transport of liquid fuels via Transnet Pipelines (TPL) increased strongly in January 2023, with the pipeline component of the Ctrack Transport and Freight Index increasing by 6.1% on a monthly basis, however, still tracking 2.1% lower when compared to a year earlier.

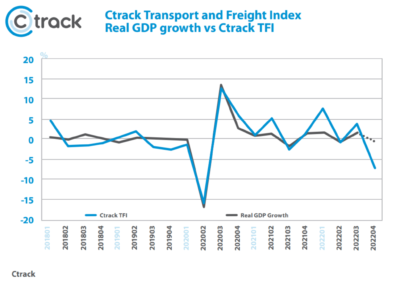

The Ctrack TFI and GDP growth.

The December 2022 Ctrack Transport and Freight Index (112.1) declined notably compared to the September level (120.7), signalling that the transport sector has probably been a negative contributor to economic growth in the fourth quarter of 2022. The transport sector will most likely underperform compared to some of the other sectors of the economy, in contrast to its outperformance during the third quarter. The negative impact of the prolonged Transnet strike put a damper not only on the transport sector’s contribution, but also the broader economy’s performance during the fourth quarter, given linkages to other sectors. This is already evident in negative growth rates recorded in the fourth quarter of last year for both the mining and manufacturing sectors, which are both heavily reliant on the transport sector, and a consensus view that the economy contracted on a quarterly basis during the fourth quarter.

Over and above the strike’s impact, the ongoing challenges of harsh load shedding, the high costs of living, increased production costs due to high fuel prices, rising wage demands and elevated interest rates, will continue to contribute to the country’s dismal economic performance into 2023.

“The South African economy is in dire need of a functioning logistics network amid all the economic woes currently plaguing our country and all stakeholders should unite to address the obstacles in the industry. From this point of view, recent developments to address the sector’s challenges, as mentioned in the 2023 National Budget, is indeed a step forward and welcomed,” concluded Jordt.

Graph 4: Real GDP growth vs Ctrack TFI (q/q change)

Source: Ctrack, TNPA, StatsSA, SARS, N3 and N4 toll concessions, ACSA, ACOC, IATA.