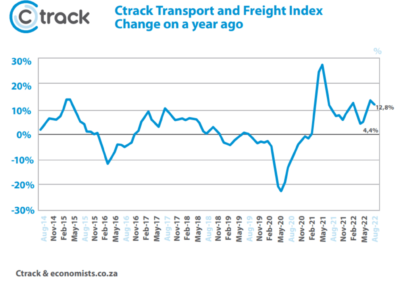

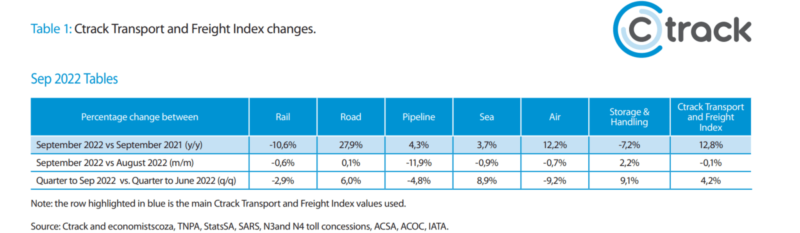

Following three consecutive months of growth, the South African logistics sector as measured by the Ctrack Transport and Freight Index declined marginally during the month of September, however the third quarter still returned growth. The Ctrack Transport and Freight Index (Ctrack TFI) declined by 0.1% on a monthly basis in September compared to the revised growth of 2.2% experienced in August, representing annual growth of 12.8%, down from a revised 13.7% in August.

Economic conditions in the South African economy took a turn for the worse during September, with Eskom data confirming that the South African economy experienced the worst-ever month of load shedding, with 572 of the month’s 720 hours directly affected. Analysis by Eskom’s Research, Testing and Development department further showed that, besides 2021, there were more power cuts in September 2022 than had been experienced in any other entire year since load shedding started in 2007. The negative impact of load shedding reaches all spheres of the economy, including the logistics and supply chain sector. Companies buckle under the inability to produce at capacity, the cost of lost production, reduced productivity, the cost of providing alternatives and reduced margins.

Graph 1: Ctrack Transport and Freight Index % change on year ago.

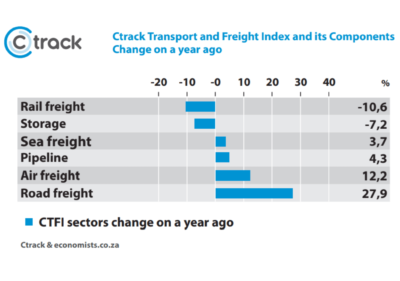

The sector continues to be plagued by many challenges, including significant fuel price increases in recent months, rising interest rates, the higher cost of tyres and spare parts, delays at ports, sabotage and unrest, railway woes and the negative impact of regular load shedding. Despite these challenges, the logistics sector proved to be largely resilient with four of the six sectors measured by the Ctrack Transport and Freight Index increasing on an annual basis during September. While the broader economic environment has a real effect on all the sectors measured by the Ctrack Transport and Freight Index, there are still vastly different trends evident in each of these sub-sectors.

Graph 2: Ctrack Transport and Freight Index components (% change on year ago)

Road Freight remains a strong performer, followed by Air Freight, with both sectors posting double-digit growth in September compared to a year earlier, while Rail Freight remains the regular underperformer among the sub-sectors.

“Despite all the challenges that continually batter this industry the resilience of the transport industry and especially Road Freight has continued to surprise with continued growth despite all these challenges, but I fear that is not sustainable indefinitely,” says Hein Jordt, Chief Executive Officer of Ctrack Africa.

The significant performance of the Road Freight sector has been an on going theme since mid-2020. Although treading water in the month of September, the Road Freight segment still increased by a notable 27.9% compared to the same period last year, a continuation of a positive growth streak that started in January 2021. While the number of heavy trucks on the N3 and N4 toll routes remained unchanged on a monthly basis in September, heavy traffic still increased by 11% compared to the same period last year. Among other reasons the segment continues to benefit from the on going underperformance of the rail industry.

Air Freight continued to show signs of strain in September, with the Air Freight segment of the Ctrack Transport and Freight Index declining by 0.7% compared to the previous month, which is also the fourth consecutive monthly decline. Despite these declines the segment is still tracking 12.2% higher than it did at the same time last year. Total consolidated airport flight movements declined by 1.5% in September, but air cargo recovered somewhat.

The transport of liquid fuels via Transnet Pipelines (TPL) declined notably in September, with the Pipeline segment of the Ctrack Transport and Freight Index declining by a 11.9% compared to the previous month, but still tracking 4.3% higher than the same period last year. South Africa’s own production of fuel has been on a downward trend in recent years given that four oil refineries have closed down. The shortage of refineries has created a scenario where the country is increasingly reliant on imports, and supply line disruptions present a greater risk, as highlighted by the recent Transnet strike that affected operations at the Durban port.

The Sea Freight segment measured by the Ctrack Transport and Freight Index increased by 3.7% in September on a year on year basis, driven by a strong recovery in container handling at various ports in recent months, while other cargo handling also increased notably during September. On a quarterly basis, Sea Freight increased by an impressive 8.9% during the third quarter.

The Rail Freight component of the Ctrack Transport and Freight Index declined by 10.6% year on year in September, the sixth consecutive monthly decline, which can be attributed to amongst other factors, large-scale theft of copper cables, insufficient maintenance, lack of locomotives and corruption. These on going challenges are likely to remain a reality in this space for some time to come.

“It is great to see that government is taking real steps to assist the transport and logistics industry and save the ailing rail network,” says Jordt.

Finance Minister Enoch Godongwana admitted during his speech as part of the Medium Term Budget Policy Statement (MTBPS) that there is a crisis in the logistics sector and that inefficiencies in the port and rail infrastructure are costing the economy billions.

This commitment includes the passing of the Economic Regulation of Transport Bill while requests for proposals have been issued for third party-access to the freight rail network and private-sector partnerships for the Durban Pier 2 and Ngqura container terminals. In addition Transnet has been allocated R2.9 billion to bring out-of-service locomotives back into service and improve rail capacity. A further R2.9 billion has been allocated to deal with flood damage in Kwazulu-Natal.

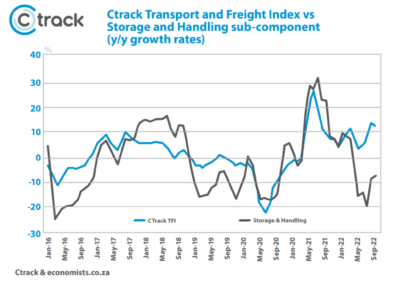

Zooming into the Storage and Handling sub-sector of the Ctrack Transport and Freight Index revealed another dismal performance, this sector has clearly been underperforming since the beginning of 2022. The lacklustre economic environment, as well as global supply chain pressures, has played an important role in companies’ management of inventories. Inventories consist of all outputs that are held by the enterprise after production and prior to their further processing, sold, delivered to other units or used in other ways as well as products acquired from other enterprises that are intended to be used for intermediate consumption or for resale without further processing (factored goods).

Locally, inventory holdings in the manufacturing sector as measured by a sub-component of the ABSA PMI, dropped by 12.8% between January and June, before recovering quite notably in Q3. Similarly, the value of raw materials and work-in-progress of all industries covered by StatsSA’s Quarterly Financial Statistics declined in the first quarter before gradually increasing in Q2 and Q3. Although the Storage and Handling segment still declined by 7.2% on an annual basis during September, it seems that the sector is making a turn for the better as reflected in two consecutive positive monthly growth rates as well as a sizeable 9.1% quarter on quarter growth which it recorded in Q3.

The Equites Property Fund, a JSE company solely focusing a logistics-only play, recently noted that they are experiencing record demand for warehousing space. The pandemic-related surge in online shopping has ignited demand for warehouse and distribution facilities for retailers and e-commerce players to store goods before delivery and has also had a positive impact on Road Freight, particularly when it comes to parcel delivery.

According to the StatsSA land transport survey, income generated from parcel delivery has increased by 79.1% since January 2020.

“The on going pressures facing all the segments measured by the Ctrack Transport and Freight Index mean that the businesses in these segments are facing rising risk levels and shrinking profit margins. The implementation of a bespoke fleet management system has been well proven to mitigate risk, increase profitability and ensure peace of mind in a turbulent environment,” concludes Jordt.

Graph 3: Ctrack Transport and Freight index vs. Storage and Handling sub-component (y/y growth rates)

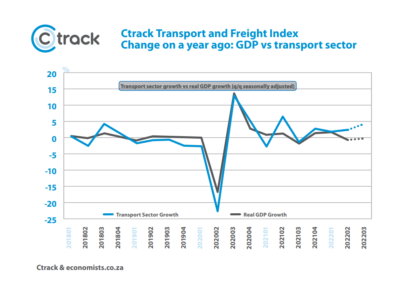

The Ctrack TFI and GDP growth.

The September 2022 Ctrack TFI (120.1) increased notably compared to the June index level (115.3), signalling a further recovery in the transport sector in Q3. However, September and the third quarter in general has been a particularly challenging month for the South African economy thanks mostly due to the aforementioned on going harsh load shedding. High-frequency data from some of the most energy-intensive sectors like mining and manufacturing have already provided clues about the effects of the power cuts on economic activity and it does not paint a pretty picture.

There is a growing probability that the economy as a whole has slipped back into a technical recession, with the likelihood of a negative quarter on quarter growth rate during the third quarter. Encouragingly, the transport sector outperformed the broader economy during the second quarter, increasing by 2.4% compared to the previous quarter seasonally adjusted vs. a 0.7% contraction in overall real GDP growth and this trend is likely to have prevailed in the third quarter. The transport sector was, however, hit hard by the recent prolonged strike of Transnet staff in October, which will firmly put the sector on the back foot in the fourth quarter.

Graph 4: Real growth: GDP vs. transport sector

* Revision note – the release of StatsSA’s Quarterly Financial Statistics survey after the publication of the August Ctrack TFI, resulted in an upward revision to the inventory data used to calculate the Storage and Handling sub-component and thus resulted in an upward revision to the August Ctrack TFI.

Source: economistscoza, TNPA, StatsSA, SARS, N3and N4 toll concessions, ACSA, ACOC, IATA.