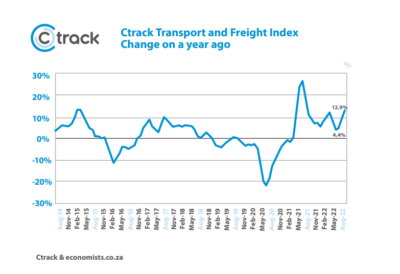

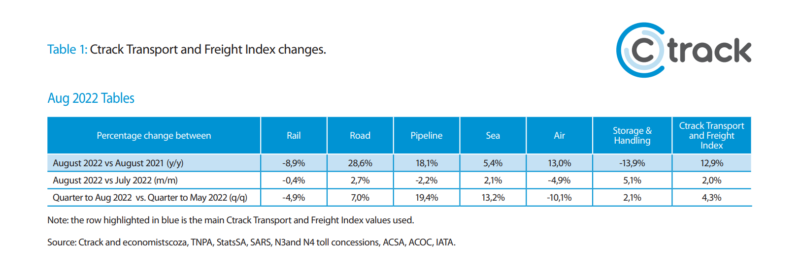

The South African logistics sector continued to improve during the month of August, building on its strong Q3 performance. The Ctrack Transport and Freight Index (Ctrack TFI) grew by 2.0% in August compared to July, which represented a 12.9% improvement compared to a year ago, and an improvement on July’s revised 9.0% year-on-year growth rate.

The annual comparison is, however, still influenced by a low base of comparison, as the August 2021 index was still under pressure due to the aftermath of the riots in KZN and Gauteng during July 2021. During August the Ctrack Transport and Freight Index was able to surpass March’s pre-flooding level.

Graph 1: Ctrack Transport and Freight Index % change on year ago.

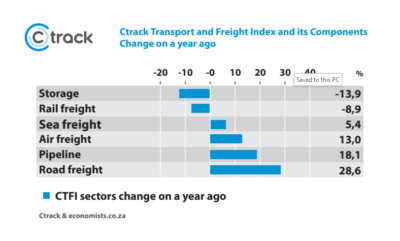

Despite many challenges that remain a reality for the sector including high fuel prices, rising interest rates and the negative impact of regular load shedding, the logistics sector proved to be largely resilient. Four of the six segments measured by the Ctrack Transport and Freight Index increased on an annual basis during August, with the star performer once again being Road Freight, followed by Pipeline Transport, Air Freight and Sea Freight. The remaining segments including Storage and Handling and Rail Freight returned declines. The latter has been on a downward spiral for five consecutive months, reflecting on going challenges in the rail sector.

“We have had a couple of months without any major disasters and the majority of the segments measured by the Ctrack Transport and Freight Index have benefitted from this stability in the general transport environment. However, further policy restraints, inflationary impact on tyres, parts and servicing items do remain a concern for the Road Transport Industry and can restrict further growth and recovery ” says Hein Jordt, Chief Executive Officer of Ctrack Africa.

Graph 2: Ctrack Transport and Freight Index components (% change on year ago)

While the broader economic environment has a real effect on all the sectors measured by the Ctrack Transport and Freight Index, there are still vastly different trends evident in each of these sub-sectors.

These trends are partly a reflection of specific infrastructural challenges (notably in rail freight), while other factors such as government policies, management, efficiency and adaptability also play an important role in the performance of the various sub-sectors.

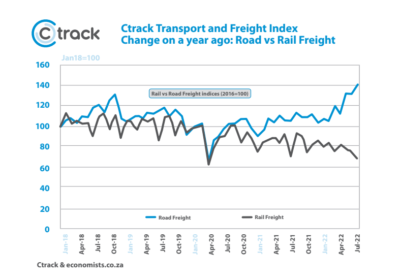

Road Freight was the best performing sub-sector during August, with a notable increase of 28.6% compared to a year ago, a continuation of a positive growth streak that emanated in January 2021. While the number of heavy trucks on the N3 and N4 toll routes declined by 2.7% during August, StatsSA reported that Road Freight payload for the country as a whole has shown continuous growth, with a 34% improvement on an annual basis. The sector has been a beneficiary of the on going underperformance of the rail industry but has also been able to capitalise on the evolving trend of parcel delivery, driven by increases in the popularity of online shopping. According to the StatsSA land transport survey, income generated from parcel delivery has increased by 108.7% since January 2018.

Graph 3: Comparison between payload for rail and road freight transportation

The Rail Freight component declined by 8.9% year-on-year during August, the fifth consecutive month of decline, which can be attributed to large-scale theft of copper cables, insufficient maintenance, lack of locomotives and corruption.

Transport Minister Fikile Mbalula recently commented that the Department of Transport is working with the Department of Public Enterprises to get trucks off the road, by moving at least 10% from road onto rail within the next five years.

The White Paper on National Rail Policy was approved by cabinet in March 2022, and tabled in parliament, seeking to enable the government to implement the ambitious policy choices it has made, including radical structural reforms that not only seek to restore the competitiveness of the railway system but also enable private sector participation through concessions.

The transport of liquid fuels via Transnet Pipelines (TPL) increased in the past three months, with the pipeline component of the Ctrack Transport and Freight Index growing by 18.1% during August compared to the same period last year. South Africa’s own production of fuel has been on a downward trend recently with four oil refineries closing their doors. South Africa once relied on imports for hardly a third of its refined fuel, but the situation has changed notably and bigger volumes of final products are now being imported and transported via pipeline to the Gauteng market on a regular basis.

The Air Freight sector showed signs of strain during August and declined by 4.9% on a monthly basis, the second month of decline, however, it is still tracking 13.0% higher than a year ago.

This is in line with global trends as demand comes under increasing pressure due to higher inflation and interest rates globally, which is impacting trade flows and demand for imports and exports.

Sea Freight grew by 5.4% in August compared to a year ago, driven by a strong recovery in container handling at various ports in recent months. Storage and handling remained under pressure in August, declining by 13.9% on an annual basis, reflecting generally lower inventory levels in the economy.

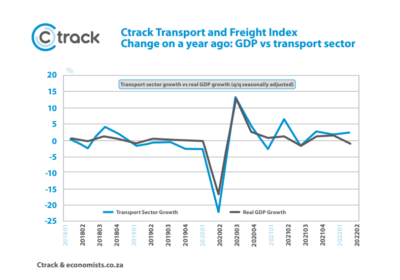

The Ctrack Transport and Freight Index and GDP growth.

While the first quarter’s real GDP growth was stronger than expected, the economy lost momentum in the second quarter due to the impact of the KZN flooding during April, regular load shedding, higher inflation and rising interest rates.

Encouragingly, the transport sector outperformed the broader economy during the second quarter, increasing by 2.4% compared to the previous quarter seasonally adjusted vs. a 0.7% contraction in overall real GDP growth. Despite many headwinds currently being experienced by the broader economy, early indications are that the transport sector might outperform South Africa’s GDP once again during the third quarter. The August 2022 Ctrack TFI (119.2) increased notably compared to the June index level (114.8), signalling a further recovery in the transport sector in Q3.

However, September has been a particularly challenging month for the South African economy, due to load shedding, which will have an overall dampening effect on the broader economy.

“There is no doubt that South Africans and the South African economy is currently under pressure due to a variety of factors, so it is heartening that the transport industry as a whole continues to rise above these challenges and outperform the country GDP,” concludes Jordt.

Source: economistscoza, TNPA, StatsSA, SARS, N3and N4 toll concessions, ACSA, ACOC, IATA.